3 Oil Stocks to Buy Now

There are 3 oil stocks to buy while oil prices remain low.

I’ll tell you what those stocks are in a moment, but first, let’s talk about why oil prices plummeted more than 2% yesterday.

There are any number of reasons why oil prices can fall that far, that fast. Perhaps the most obvious is the result of economic slowdowns.

Certainly we saw evidence of this during the Great Recession of 2007 / 2008, when oil prices fell from $147 a barrel to less than $40 a barrel.

We saw this again during COVID, too, when the global economy came to an abrupt halt, and oil prices actually dipped into negative pricing.

And now, as a result of Trump’s trade war, we’re seeing it again.

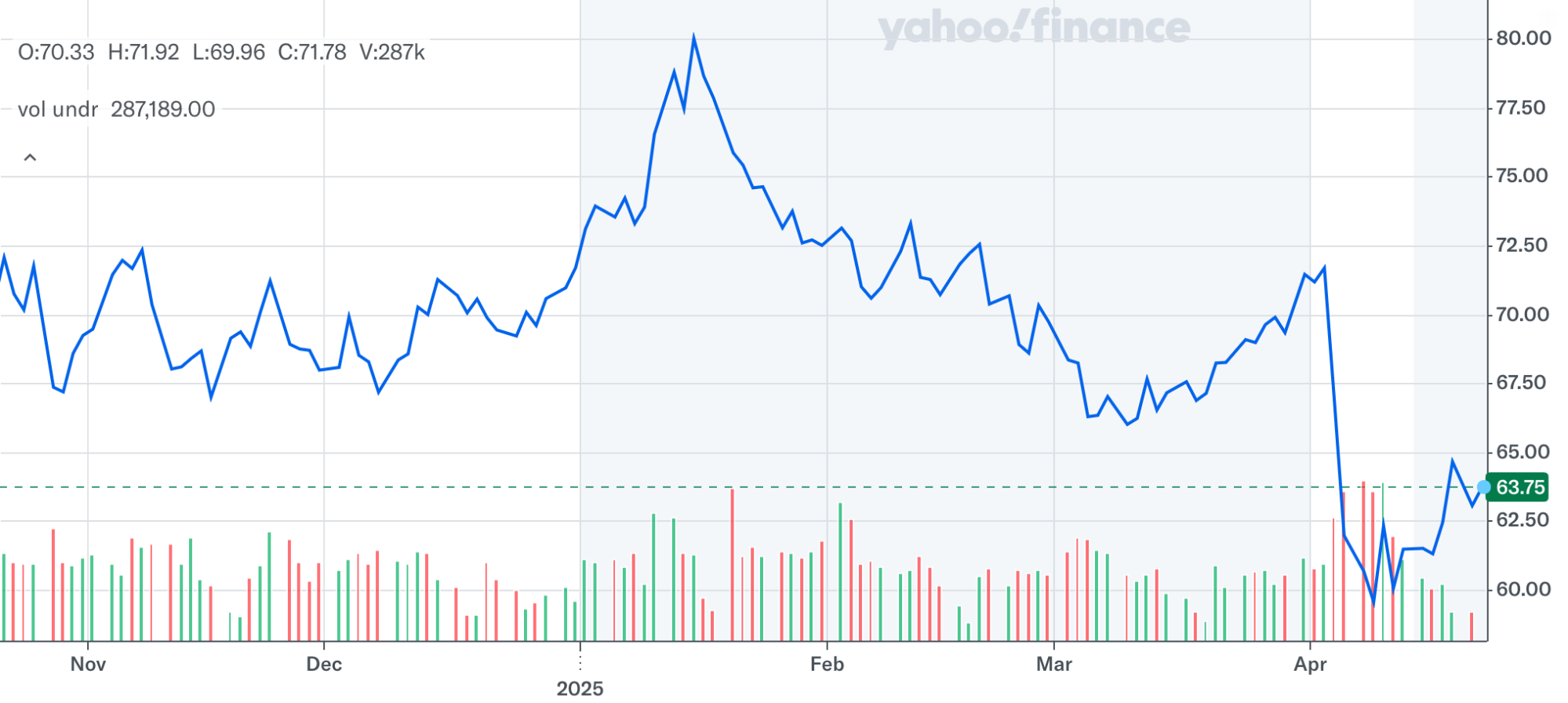

Around the middle of January, oil was trading at around $80 a barrel. Two weeks ago, it fell below $60 a barrel.

But something interesting happened yesterday, that put more downward pressure on crude.

Reports came out claiming that there have been signs of progress in talks between Iran and the U.S. Even the mildest glimmer of peace between these two nations alleviated a bit of the concern that Iranian / U.S. relations were worsening. To be sure, they’re still pretty bad. But the news definitely contributed to that dip in oil prices.

According to Onyx Caital’s head of research, Harry Tchilinguirian, the U.S.-Iran talks seemed relatively positive, which allows for people to start thinking about the possibility of a solution. He went on to say …

The immediate implication would be that Iranian crude would not be off the market.

Certainly no rational person wants more geopolitical strife between the U.S. and Iran, but oil investors tend to do better when it’s there.

In any event, even with oil rebounding this morning, prices are still relatively low. And will likely fall further if this trade war continues, thereby pushing the global economy closer to recession. Truth is, oil prices could easily fall back below $50 again. And that would be good news for consumers, and even better news for investors looking to capitalize on a temporary dip in oil prices. Because make no mistake: trade wars, recessions, and even general economic uncertainty don’t last forever. And when they end, oil prices always climb back up.

The question, of course, is how low should oil prices go before you start buying?

To be sure, the profitability threshold for oil producers is around $45 a barrel. And that’s for existing wells. For new wells, particularly in the Midland Basin, prices need to clock in at around $61 a barrel.

How low it will go is still unknown. But Goldman Sachs sees 2025 average oil prices coming in at $63, and $55 for 2026. I actually think $63 is too optimistic, and wouldn’t rule out seeing prices briefly fall below $55 this year. But until we get some clarification on how these tariffs are going to play out, it’s going to be hard for oil investors to navigate this trade war. That being said, if you’re up for day trading some of these oil stocks, this year will be a good time to do it.

3 Oil Stocks to Buy on the Next Big Dip

There are dozens of oil stocks you can trade for a quick buck, but three in particular stick out with me …

- ProShares Ultra Bloomberg Crude Oil (NASDAQ: UCO)

- ProShares UltraShort Bloomberg Crude Oil (NYSE: SCO)

- Civitas Resources (NYSE: CIVI)

The first two are leveraged ETFs that can deliver the most bang for your buck on these wild price swings. UCO offers 2x daily leverage to an index that consists of crude oil futures contracts. SCO corresponds to two times the inverse (-2x) of the daily performance of

vestment results that correspond to two times the inverse (-2x) of the Bloomberg Commodity Balanced WTI Crude Oil Index.

Because of the leverage with these two ETFs, your gains could be significantly higher than you might find with one specific oil stock or a basic ETF. To be sure, the same is true regarding losses. If you were to lose money on either of these ETFs, those losses would be significantly higher than you might find with a regular oil ETF. So keep that in mind.

In terms of a specific oil company, I’m partial to Civitas Resources. It’s a small player in the U.S., but it’s been quite active in reducing its debt load (before this trade war was started), and increasing its free cash flow. I also like that it pays a very generous 7% dividend. To clarify, Civitas would be a buy on weakness, and is intended as a long-term investment.

Indeed, 2025 will be a rough ride for the oil industry. But if you’re able to game it right, you can use this rough ride to make some decent coin.

Jeff

Array